What is Forex Spread

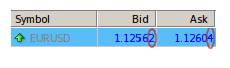

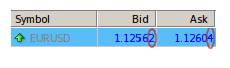

A spread is the difference between the buy also known as the bid price and the sell also know as the ask price. You will have two prices that are given for a currency pair.

The spread is defined as the price between where a trader may purchase or sell an underlying asset. Also know that the spreads are variable meaning they will not always remain the same and will change sporadically. Many specialist promise low spread which means a smaller movement in exchanges rates lets you profit from a trade more easy then you would have if the spread was higher.

Just keep in mind that the spread is where the specialist will make their money so when you invest you will pay the spread first so you will see a loss of whatever the spread is before you can profit. If you invested in the right direction it shouldn’t take that long to see a gain of pip and a profit.

Here is an Example of Forex Trade and Spread

In this example, I will use the British Pound (GBP) and the U.S. dollar (USD). Now let’s say that the GBP may be worth 1.1642 USD. You may think that the GBP will rise against the dollar, so you buy at the asking price. But the asking price won’t be exactly the 1.1642; it’s going to be little more let say 1.1644, which is the price you pay for the trade. Meanwhile, the seller on the other side of the trade won’t receive the full 1.1642 either; he’ll get a little less, perhaps 1.1640. The difference between the bid and ask prices is the spread comes which in this case will be 0.0004. That’s what the specialist keeps for taking the risk and making the trade.

So as you can see the spread is is the difference between the bid and the ask price real simple. You will need to make up the difference of the spread before you can see any profit on your investment. I would recommend opening an account with easy forex they currently have a really good spread and also they have good leverage. If you don’t know what leverage is here read what is leverage.

Very important to keep in mind that before you invest make sure you know how much is the spread before you enter into a contract. You don’t want to invest thinking that you are going to take a 5 pip profit when your spread is 2-6 pip that means you have to gain a 7-11 pips to hit your 5 pip profit goal. As you can see that spread really affects your trade if you’re not mentally prepar and always keep a journal of your gains and loss it helps to make better decisions.