What is Forex Pip?

profit pip example

A pip stands for percentage in point and measures. To simplify though, a pip is what we in the forex would consider a “point” for calculating profits and losses. In order to trade successfully you need to understand how to calculate its value.

A pip is a number value one pip is the smallest price change that an exchange rate can make. In the Forex market, the value of currency is given in pips. One pip equals 0.0001, two pips equals 0.0002, three pips equals 0.0003 and so on.

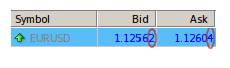

Most currencies are priced to the four numbers after the point.

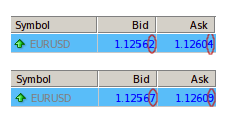

For example a 2 pip spread for EUR/USD is 1.12562/1.12604.

In the major currencies, the price of the Japanese yen-based currency pairs are an exception as well as gold, oil, brent and gas they are displayed to only two decimal places (0.01) – so a quote for USD/JPY looks like this: 83.19/83.22. This quote has a seven pip spread between the buy and sell price.

Some brokers now offer fractional pips also called “pipettes” to provide an extra digit of precision when quoting exchange rates for certain currency pairs. A fractional pip is equivalent to 1/10 of a pip. For instance, if EUR/USD moves from 1.32209 to 1.1.32228, that .00001 USD move higher is ONE PIPETTE.

Calculate the value of a pip?

Now don’t confuse the spread pip with gain and loss pip’s also read more about what is forex spread.

Let’s calculate the value of a pip for a certain currency pair. In the example, we are going to use a quote with a 4 decimal place. If your account is denominated in USD, for example, each pip (depending on the currency pair) is worth about $1. In a micro account, each pip is worth roughly 1/10th the amount it would be worth in a standard account — so about $0.10 you will find an example below.

- 1,000 units is equal to $0.10 per pip EUR/USD

- 10,000 unit is equal to $1.00 per pip EUR/USD

- 100,000 units is equal to $10.00 per pip EUR/USD

First we are going to start with a trade size. Micro lots are 1k (refer to the above chart), so if you want the value of a pip for a micro lots you can start with 1,000. If you want the value of a pip for a standard lot, you start with 10,000. You then multiply your trade size by one pip for the pair that you are trading.

10,000 * 0.0001 = 1US Dollar

In my example we are going to calculate the value of a pip for one 10k lot of EUR/USD. So since I am using a standard 10k lot, I’m going to start with 10,000 unit. I multiply 10,000 by .0001 as above and since 1/10,000th is a pip for all pairs (except Japanese Yen pairs). That would get us a value of 1. That will be valued in the “counter currency” (second currency) of the pair that I am trading. In this example, I am trading EUR/USD, so USD is the counter currency of the pair. One pip is worth 1 USD dollar for one 10k lot of EUR/USD.

Now for every 1 pip move that the EUR/USD makes in the market you will make $1 profit or loss. You can apply the same math to all the other pairs to get the value of the pip.

Here are some great books: